Powerful tech tools that help you manage and grow your practice — and collaborate with your clients

We’ve invested $1.5 billion into our digital strategy —modernizing technology is meant to enhance the human part of our business with keen productivity and an elevated client experience. As an Edward Jones Financial Advisor, you have a full spectrum of powerful tech tools to support your practice. But more important than any one tool is how they all work together. Seamless, integrated, with easy interfaces for both you and your clients — so you can both focus on achieving their most important financial goals.

Associate Testimonial

Manage:

Tech that boosts your productivity now and in the future — helping you stay on track with each of your clients and build deeper relationships with each of them over time.

Our next-generation tools set the stage for success, fueled by the knowledge and insights they will provide. Our new systems capture data in a way that helps us structure our insights and ultimately build the capabilities that help create innovative solutions.

Our financial advisors enjoy the efficiency and time savings that come from an integrated tool suite where all systems talk to each other. Clients can easily link outside accounts for a holistic view of their financial picture — and account information is updated in real-time. Everything you need to serve your clients is all in one place and easy to access from anywhere.

MoneyGuide

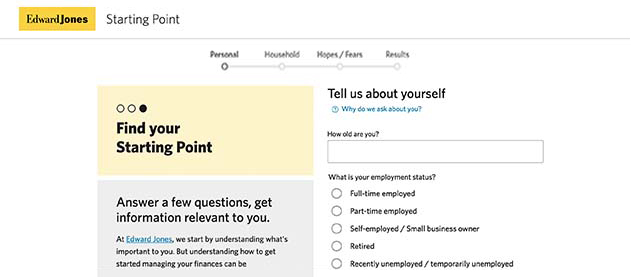

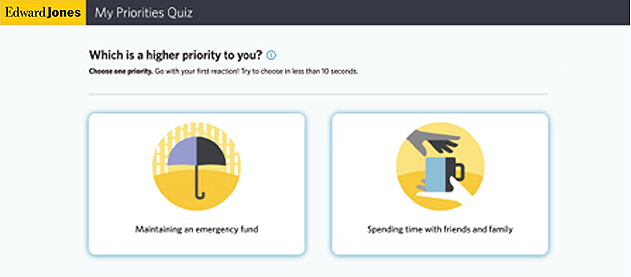

MoneyGuide is an interactive planning tool to use with clients when discussing their financial journey and what is most important to them. This goals-based advice approach allows you to engage with your clients on a personal level, as it prompts conversation and helps build a client’s investing strategy. With its “always on” discovery mechanism, it routinely helps clients prioritize and visually reassess their investing choices based on their changing needs.

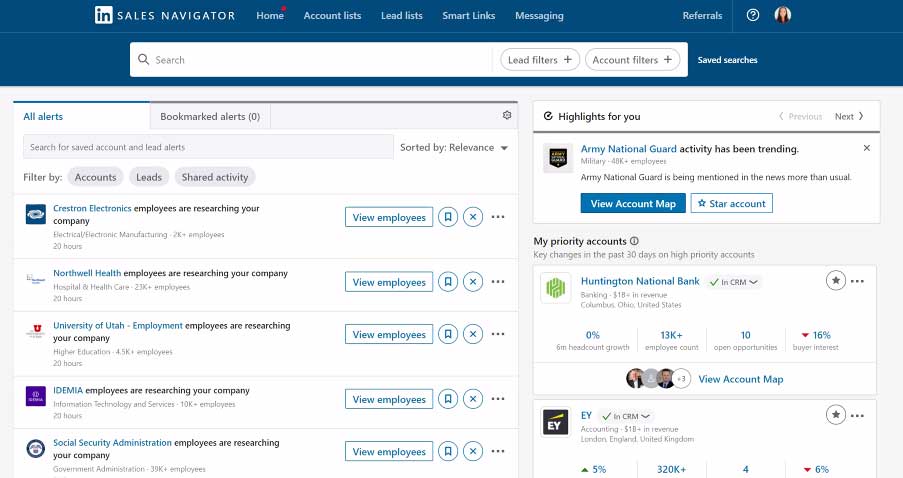

Salesforce

As our Client Relationship Management (CRM) platform, Salesforce enables our commitment to our clients to stay current on their investing needs and ambitions. It allows our financial advisors to keep client relationships and daily activities organized in one central hub.

- Start Your Day – insights highlighting client-level opportunities for your appointments occurring that day, with established practices on how to best conduct those conversations. Plus, relevant trending news and market insights.

- Guided Next Steps – AI surfacing and recommending pertinent details for each task on your action plan to efficiently and dynamically drive positive business outcomes. Gen AI also scans notes to surface next best actions and opportunities for a client.

- Attract New Clients –build your business and brand effectively with smart campaigns and insights-powered tools that allow you to know and interact with all your clients and prospective clients in a personalized way at scale. Plus, Gen AI writing email campaign content for you based on client needs and preferences.

- Stay Closely Connected – leverage text messages content to inform Next Best Actions, as well as utilizing Search to surface text messages to easily identify and inform client interactions.

Remote system access

Remote system access gives you the power to work anywhere and access everything available at your branch office. At the park with your kids and need to respond to a client text? No need to return to the office to look up account information — just check your mobile app. In the office, working remotely or on the go, our tech is there for you — so you can be there for your clients.

Secure client communications

Use e-signature to get important documents signed via email. Confirm updating a client goal with a text. Schedule an account review via Zoom. Our technology makes it easy to communicate with clients, keep them on track with their goals, and grow your practice.

- E-signature via email

- Secure text messaging

- Zoom meetings

Grow:

Digital client creation tools help you find your next best clients — and keep you focused on what matters most.

Investors increasingly want to engage with their financial advisors through digital technology. They also want a trusted relationship with a financial advisor looking out for their best interests. Our digital tools are designed to facilitate meaningful conversations to help you discover what’s important to your clients — both existing and new — so you can build deeper relationships and help them achieve their goals.

Edward Jones Marketing Hub Tools

Collaborate:

Easy access to account information and goals tracking keeps you both on the same page.

When you and your clients have real-time access to account and goals-tracking information, it creates a seamless experience that virtually eliminates any chance that their wants and needs get lost in translation. A beautifully matched partnership in which you are in synch, communicating and continually collaborating to achieve their goals.